这是一份很久以前一份作业报告.

1 第一题

1.1 加载工具包

# 加载工具包

library(plyr)

library(quantmod)

library(TTR)

library(ggplot2)

library(scales)

library(stringr)

library(dplyr)

library(lubridate)

library(dygraphs)

library(RColorBrewer)

library(ggfortify)

library(dplyr)1.2 输入要研究的股票数据代码

####################################### 输入要研究的股票数据代码##### 中国银行 601988.SS 中国建设银行 601939.SS 农行

####################################### 601288.SS 浦发银行 600000.SS 民生银行 600016.SS 下载数据

title <- "浦发银行" #股票名字作为图片标题 ,

stock <- "600000.SS" # 股票的代码

sDate <- "2015-1-1" #开始日期

eDate <- "2018-10-01" #结束日期1.2.1 下载数据并保存到本地

## 上面的参数 eval=FALSE 代码这代码块不执行

download <- function(stock, from = sDate, to = eDate) {

df <- getSymbols(stock, from = from, to = to, env = environment(), auto.assign = FALSE) #下载数据

names(df) <- c("Open", "High", "Low", "Close", "Volume", "Adjusted")

write.zoo(df, file = paste(stock, ".csv", sep = ""), sep = ",", quote = FALSE) #保存到本地

}

download(stock) # 这个是从网上下载数据,如果只研究一只股票,建议运行第一次以后,进行注释改代码

1.2.2 读取本地股票数据

# 本地读数据

read <- function(stock) {

as.xts(read.zoo(file = paste(stock, ".csv", sep = ""), header = TRUE, sep = ",",

format = "%Y-%m-%d"))

}

data <- read(stock)

cdata = data$Close1.2.3 删除该文件

file.remove(paste0(stock, ".csv")) # 删除存储的文件

#> [1] TRUE1.3 计算日、月、年、收益率(按收盘价) 并保存数据

daily_return = dailyReturn(cdata) # 日收益率

monthly_return = monthlyReturn(cdata) # 月收益率

yearly_return = yearlyReturn(cdata) # 年收益率

# #保存股票的日收益率 write.zoo(daily_return,paste0(stock,'_daily_return.csv'),

# quote = FALSE, sep = ',')

# #保存股票的月收益率

# write.zoo(monthly_return,paste0(stock,'_monthly_return.csv'), quote = FALSE,

# sep = ',')

# #保存股票的日收益率 write.zoo(yearly_return,paste0(stock,'_yearly_return.csv'),

# quote = FALSE, sep = ',')1.4 计算 日收益率的均值 和波动率

sprintf(paste(stock, "日收益率的均值: %f"), mean(daily_return)) # 日收益率的均值

#> [1] "600000.SS 日收益率的均值: 0.000085"

sprintf(paste(stock, "日收益率的波动率: %f"), sd(daily_return)) # # 日收益率的波动率

#> [1] "600000.SS 日收益率的波动率: 0.017104"1.5 计算移动平均值(5,10,20,60期移动平均值) 并保存数据

# 移动平均

ma <- function(cdata, mas = c(5, 10, 20, 60)) {

ldata <- cdata

for (m in mas) {

ldata <- merge(ldata, SMA(cdata, m))

}

# ldata<-na.locf(ldata, fromLast=TRUE) #是否把NA进行均值填充

names(ldata) <- c("Value", paste("ma", mas, sep = ""))

return(ldata)

}

ldata = ma(cdata, c(5, 10, 20, 30, 60)) # 股票的 5 ,10 ,20 ,60 期移动平均值

# # 保存股票的 5 ,10 ,20 ,60 期移动平均值

# write.zoo(ldata,paste0(stock,'_',title,'_ma.csv'),quote = FALSE, sep = ',')

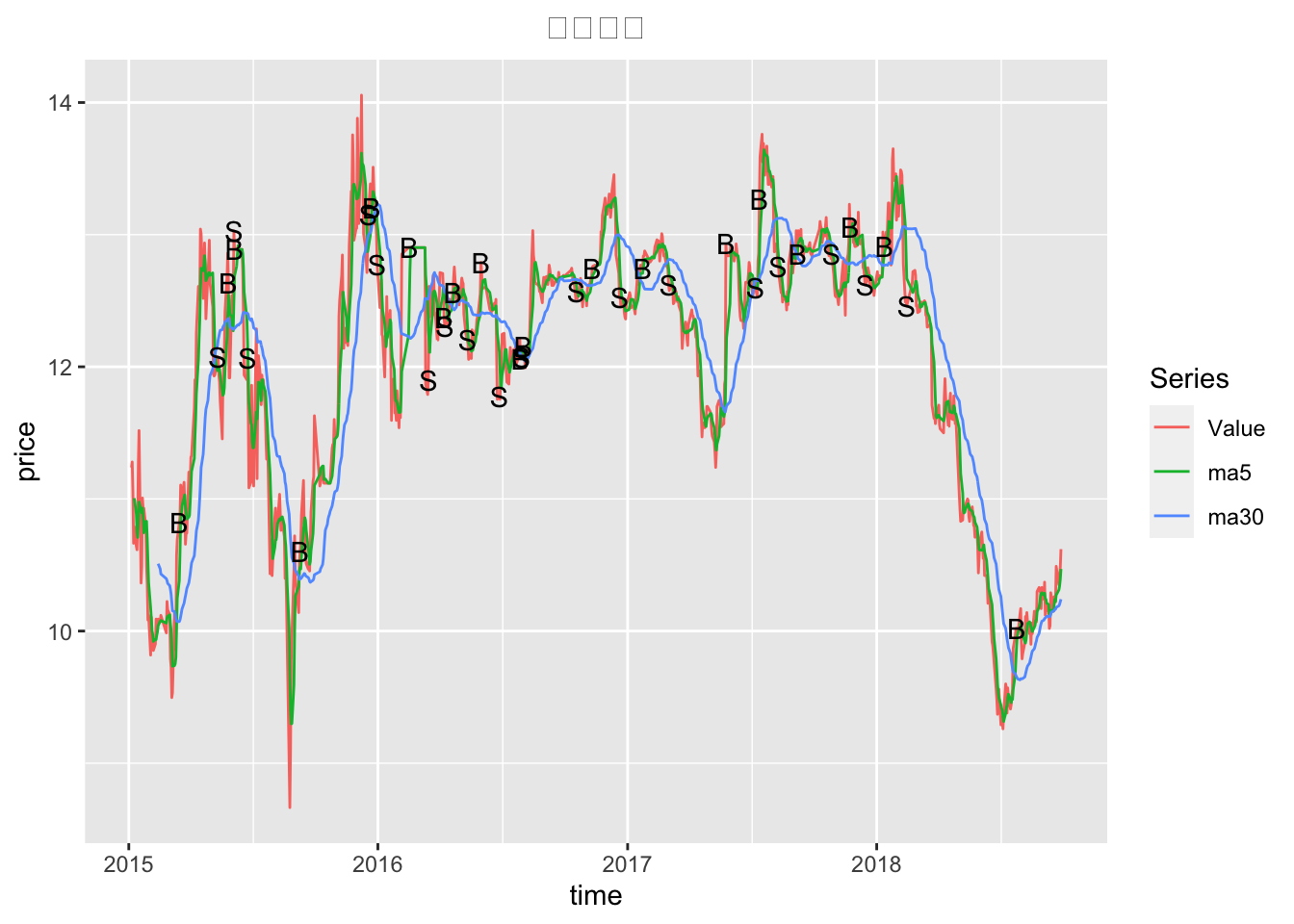

1.6 画出收盘价与5 期 30 期移动平均线

ldata = ma(cdata, c(5, 30))

dygraph(ldata) %>% dyOptions(colors = c("red", "blue", "green")) %>% dySeries(names(ldata)[2],

strokeWidth = 2, strokePattern = "dashed") %>% dySeries(names(ldata)[3], strokeWidth = 2,

strokePattern = "dashed") %>% dyRangeSelector()1.7 寻找金叉死叉,即买卖点

ma_lag_data = function(ldata) {

SMA5 = embed(ldata[, 2], 2) # 5期均线

colnames(SMA5) = c("sam5", "lagsma5")

SMA30 = embed(ldata[, 3], 2) # 30期均线

colnames(SMA30) = c("sma30", "lagsma30")

# 合并长期短期的sma

smaLS = cbind(SMA5, SMA30)

## 转换为时间序列格式

smaLS = xts(smaLS, order.by = index(ldata[, 2][-1]))

smaLS = na.omit(smaLS)

return(smaLS)

}

smaLS = ma_lag_data(ldata)

1.7.1 保存买卖点

## 构造捕捉向上突破点函数

Upcross <- function(x) {

ifelse(x[2] < x[4] & x[1] > x[3], 1, 0)

}

## 构造捕捉向下突破点函数

Downcross <- function(x) {

ifelse(x[2] > x[4] & x[1] < x[3], -1, 0)

}

# 捕捉短线 向上突破长线日期

Upsig <- apply(smaLS, 1, Upcross)

Upsig <- xts(Upsig, order.by = index(smaLS))

names(Upsig) <- "Upsig"

# 捕捉短线 向上突破长线,释放买入信号,进行买入操作

UpBuy = lag.xts(Upsig) # 判断成功以后 要过后1期进行购买

## 查看所有买入点

UpBuy[UpBuy == 1]

#> Upsig

#> 2015-03-16 1

#> 2015-05-27 1

#> 2015-06-05 1

#> 2015-09-09 1

#> 2015-12-23 1

#> 2016-02-16 1

#> 2016-04-07 1

#> 2016-04-20 1

#> 2016-05-31 1

#> 2016-07-28 1

#> 2016-08-01 1

#> 2016-11-10 1

#> 2017-01-23 1

#> 2017-05-25 1

#> 2017-07-13 1

#> 2017-09-07 1

#> 2017-11-23 1

#> 2018-01-12 1

#> 2018-07-25 1

## 捕捉短线向下突破 长线日期

Downsig <- apply(smaLS, 1, Downcross)

Downsig <- xts(Downsig, order.by = index(smaLS))

names(Downsig) <- "Downsig"

## 短线向上突破 长线,释放卖出信号,进行卖出操作

DownSell <- lag.xts(Downsig) # 判断成功以后 要过后1期进行购买

## 查看所有卖出点

DownSell[DownSell == -1]

#> Downsig

#> 2015-05-11 -1

#> 2015-06-04 -1

#> 2015-06-24 -1

#> 2015-12-18 -1

#> 2015-12-31 -1

#> 2016-03-15 -1

#> 2016-04-08 -1

#> 2016-05-11 -1

#> 2016-06-27 -1

#> 2016-07-29 -1

#> 2016-10-18 -1

#> 2016-12-20 -1

#> 2017-03-02 -1

#> 2017-07-07 -1

#> 2017-08-09 -1

#> 2017-10-27 -1

#> 2017-12-15 -1

#> 2018-02-14 -1

dim(DownSell)

#> [1] 885 1

dim(UpBuy)

#> [1] 885 1

## 买卖数据点 1为买入,-1 为卖出 0 持有点

BSdata = DownSell + UpBuy

names(BSdata) = "BS"

# 保存买卖数据点 write.zoo(BSdata,paste0(stock,'_',title,'_买卖点.csv'),quote =

# FALSE, sep = ',')

1.7.2 在图上画出买卖点,并表示标签,买入(B),卖出(S),

UpBuy1 = UpBuy[UpBuy == 1] # ## 查看所有买入点

DownSell1 = DownSell[DownSell == -1] ## 查看所有卖出点

drow_plot_2ma = function(ldata, upbuytime, upbuylabel = "B", downselltime, downselllabel = "S",

ptitle = title) {

### ldata字段包含'Value'(收盘价) 'ma5'(移动平均) 'ma20'

plot1 = dygraph(ldata, main = ptitle) %>% dyOptions(colors = c("red", "blue",

"green"), gridLineColor = "lightblue") %>% dyAxis("x", drawGrid = FALSE) %>%

dyAxis("y", label = "price(价格)") %>% dySeries(names(ldata)[2], strokeWidth = 2,

strokePattern = "dashed") %>% dySeries(names(ldata)[3], strokeWidth = 2,

strokePattern = "dashed") %>% dyRangeSelector()

for (i in upbuytime) {

plot1 = plot1 %>% dyAnnotation(i, text = upbuylabel, tooltip = "Korea")

}

for (j in downselltime) {

plot1 = plot1 %>% dyAnnotation(j, text = downselllabel, tooltip = "Vietnam")

}

plot1

}

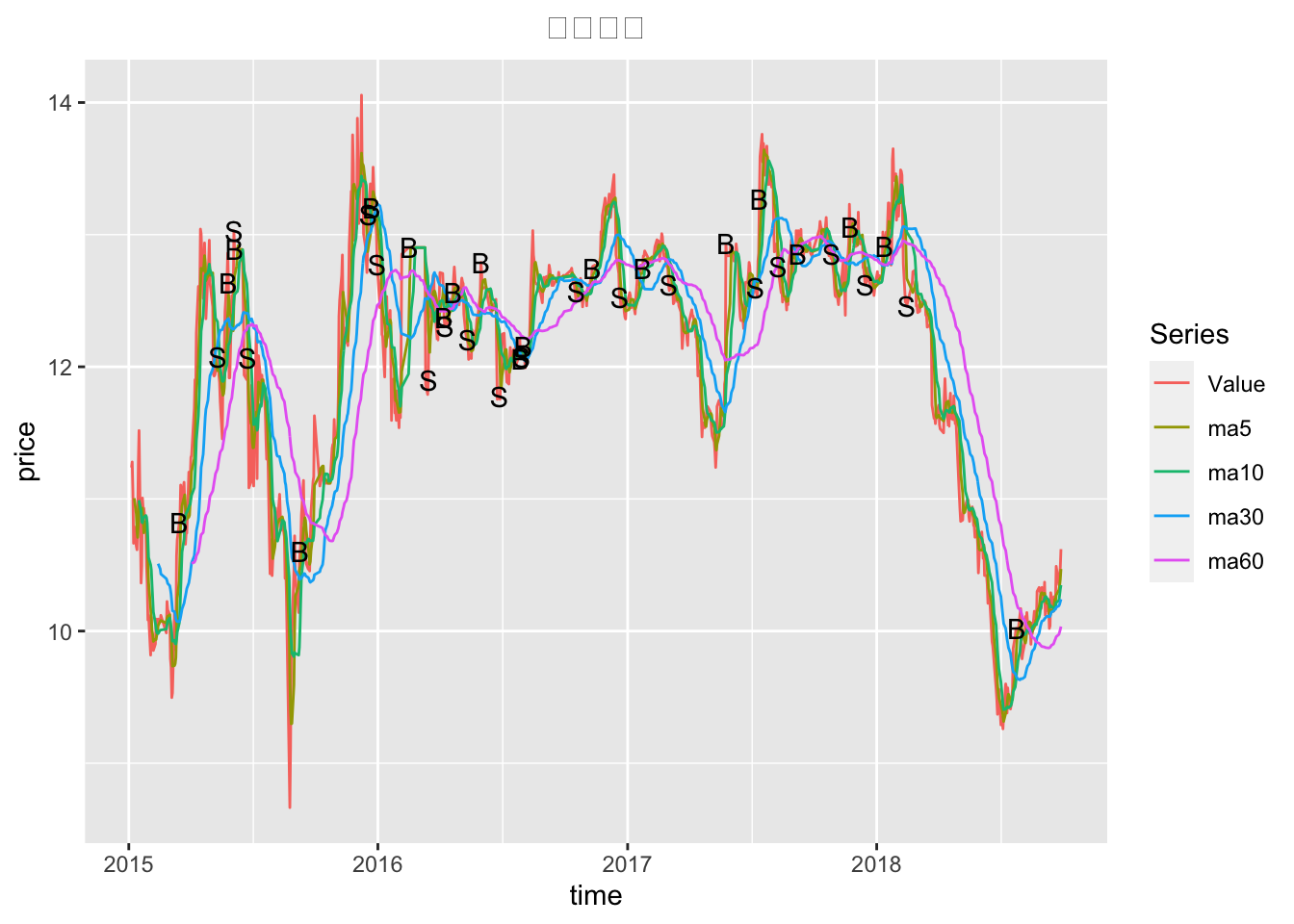

drow_plot_2ma(ldata = ldata, upbuytime = as.character(index(UpBuy1)), downselltime = as.character(index(DownSell1)))1.8 画出所用的均线5,10,30,60 图 以及 收盘价 以及 2均线形成(5,30)的金叉死叉

ldata = ma(cdata, c(5, 10, 30, 60))

drow_plot_ma = function(ldata, upbuytime, upbuylabel = "B", downselltime, downselllabel = "S",

ptitle = title) {

### ldata字段包含'Value'(收盘价) 'ma5'(移动平均) 'ma20'

plot1 = dygraph(ldata, main = ptitle) %>% dyOptions(colors = RColorBrewer::brewer.pal(length(names(ldata)),

"Set2")) %>% dySeries(names(ldata)[1], strokeWidth = 2) %>% dyAxis("x", drawGrid = FALSE) %>%

dyAxis("y", label = "price(价格)") %>% dyRangeSelector()

for (i in names(ldata)[2:length(names(ldata))]) {

plot1 = plot1 %>% dySeries(i, strokeWidth = 1, strokePattern = "dashed")

}

for (i in upbuytime) {

plot1 = plot1 %>% dyAnnotation(i, text = upbuylabel, tooltip = "Korea")

}

for (j in downselltime) {

plot1 = plot1 %>% dyAnnotation(j, text = downselllabel, tooltip = "Vietnam")

}

plot1

}

drow_plot_ma(ldata = ldata, upbuytime = as.character(index(UpBuy1)), downselltime = as.character(index(DownSell1)))

library(ggplot2)

## 用ggplot2 画线图 首先对ldata数据进行整合

library(ggfortify)

## 快速画图

ldata = ma(cdata, c(5, 30))

drow_ggplot2_ma = function(ldata, upbuytime, upbuylabel = "B", downselltime, downselllabel = "S",

ptitle = title) {

plot2 = autoplot.zoo(ldata, facet = NULL) + labs(title = title, x = "time", y = "price") +

theme(plot.title = element_text(hjust = 0.5))

for (i in upbuytime) {

plot2 = plot2 + annotate("text", x = as.Date(i), y = as.numeric(ldata[i]$Value),

label = upbuylabel)

}

for (j in downselltime) {

plot2 = plot2 + annotate("text", x = as.Date(j), y = as.numeric(ldata[j]$Value),

label = downselllabel)

}

plot2

}

drow_ggplot2_ma(ldata = ldata, upbuytime = as.character(index(UpBuy1)), downselltime = as.character(index(DownSell1)))

ldata = ma(cdata, c(5, 10, 30, 60))

drow_ggplot2_ma(ldata = ldata, upbuytime = as.character(index(UpBuy1)), downselltime = as.character(index(DownSell1)))

2 第二题 –VaR

# 加载工具包

rm(list = ls())

library(plyr)

library(quantmod)

library(TTR)

library(ggplot2)

library(scales)

library(stringr)

library(dplyr)

library(lubridate)

library(dygraphs)

library(RColorBrewer)

library(PerformanceAnalytics)2.1 输入要研究的股票数据代码

####################################### 输入要研究的股票数据代码##### 中国银行 601988.SS 中国建设银行 601939.SS 农行

####################################### 601288.SS 浦发银行 600000.SS 民生银行 600016.SS 下载数据

title <- "浦发银行" #图片标题

stock <- "600000.SS" # 中国银行的代码

sDate <- "2015-1-1" #开始日期

eDate <- "2017-12-31" #结束日期2.1.1 下载数据并保存到本地

## 上面的参数 eval=FALSE 代码这代码块不执行

download <- function(stock, from = sDate, to = eDate) {

df <- getSymbols(stock, from = from, to = to, env = environment(), auto.assign = FALSE) #下载数据

names(df) <- c("Open", "High", "Low", "Close", "Volume", "Adjusted")

write.zoo(df, file = paste(stock, ".csv", sep = ""), sep = ",", quote = FALSE) #保存到本地

}

download(stock) # 这个是从网上下载数据,如果只研究一只股票,建议运行第一次以后,进行注释改代码

2.1.2 读入数据

read <- function(stock) {

as.xts(read.zoo(file = paste(stock, ".csv", sep = ""), header = TRUE, sep = ",",

format = "%Y-%m-%d"))

}

data <- read(stock)

cdata = data$Close2.1.3 删除该文件

file.remove(paste0(stock, ".csv")) # 删除存储的文件

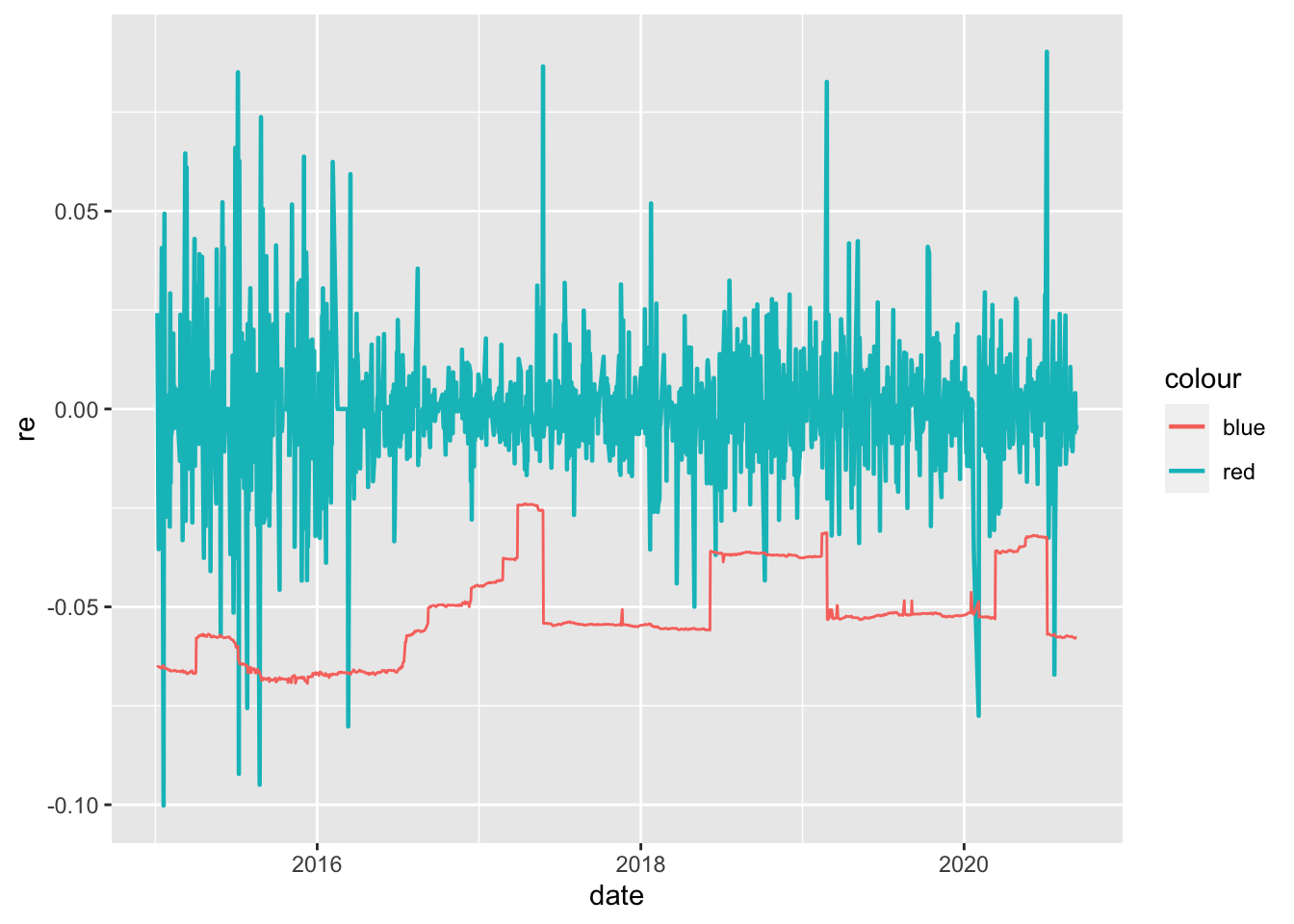

#> [1] TRUE2.2 计算VaR–历史模拟法

daily_return = dailyReturn(cdata)[-1] #cdata为收盘价,计算日收益率

daily_return_VaR = apply(embed(daily_return, 90), 1, function(x) VaR(x, p = 0.95,

method = "historical")) %>% xts(., order.by = index(daily_return[-c(1:89)]))

vardata = cbind(daily_return, daily_return_VaR)

names(vardata) = c("dreturn", "d.re.var")

### 画出VaR时序图

dygraph(vardata, main = "日收益率与VaR") %>% dyRangeSelector() %>% dyAxis("y",

label = "日收益率") %>% dyAxis("x", label = "时间")vardata1 = na.omit(vardata)

### 计算每只股票最近3年内跌幅超过VaR预测阈值的次数

VaR_count = (vardata1[, 1] < vardata1[, 2]) %>% sum()

sprintf("收益率超过VaR阈值的次数: %d,3年一共有%d有效天,占%f", VaR_count,

dim(vardata1)[1], VaR_count/dim(vardata1)[1])

#> [1] "收益率超过VaR阈值的次数: 32,3年一共有642有效天,占0.049844"2.3 计算VaR–韦伯法

library(quantmod)

ddd = xdata = getSymbols("600000.SS", auto.assign = F)

cdata <- data.frame(coredata(xdata))

names(cdata) <- c("open", "high", "low", "close", "volume", "adjprice")

cdata$date <- as.Date(.indexDate(xdata))

n <- nrow(cdata)

cdata$re = NA

cdata$re[2:n] <- (cdata$close[2:n] - cdata$close[1:(n - 1)])/cdata$close[1:(n - 1)] ## 计算日收益率

cdata = dplyr::filter(cdata, is.na(cdata$re) == F) #去除na值

n <- nrow(cdata) #提取

m <- sum(cdata$date > "2015-01-01") # 大于某个日期的天数

xdate <- cdata$date[cdata$date > "2015-01-01"] # 提前大于某个日期的天数

VaR <- rep(NA, m)

qVaR <- rep(NA, m)

zVaR <- rep(NA, m)

wVaR <- rep(NA, m)

d1 = 0

d2 = 0

d3 = 0

d4 = 0

alpha = 0.05

for (i in 1:m) {

RE <- cdata$re[(n - m - 252 + i):(n - m + i - 1)]

SRE <- sort(RE)

VaR[i] <- -(SRE[trunc(252 * alpha)] + SRE[trunc(252 * alpha) + 1])/2

qVaR[i] <- -quantile(RE, 0.05)

zVaR[i] <- -qnorm(alpha, mean(RE), sd(RE))

ERE <- exp(RE)

fn <- function(par0) {

k <- par0[1]

lambda <- par0[2]

kk = 0

for (j in 1:252) {

x = ERE[j]

kk = kk + log((k/lambda) * ((x/lambda)^(k - 1)) * exp(-(x/lambda)^k))

}

return(kk)

}

xml <- optim(c(1, 1), fn, method = "BFGS", control = list(fnscale = -1))

k <- xml$par[1]

lambda <- xml$par[2]

wVaR[i] <- -log(qweibull(alpha, k, lambda))

dre = cdata$re[n - m + i]

if (dre < -VaR[i]) {

d1 = d1 + 1

}

if (dre < -qVaR[i]) {

d2 = d2 + 1

}

if (dre < -zVaR[i]) {

d3 = d3 + 1

}

if (dre < -wVaR[i]) {

d4 = d4 + 1

}

}

ctv <- qbinom(0.05, m, alpha)

VR = data.frame(xdate, VaR, qVaR, zVaR, wVaR)

# plot(xdate,zVaR,type='l',col='blue') lines(xdate,VaR)

require(ggplot2)

VR1 = data.frame(date = xdate, VAR = VaR, gr = rep("HIS", m))

VR2 = data.frame(date = xdate, VAR = qVaR, gr = rep("qHIS", m))

VR3 = data.frame(date = xdate, VAR = zVaR, gr = rep("Norm", m))

VR4 = data.frame(date = xdate, VAR = wVaR, gr = rep("Weibull", m))

# xaa=rbind(VR1,VR2,VR3,VR4)

# ggplot(xaa,aes(x=date,y=VAR,group=gr,color=gr))+geom_line(size=0.8)

VR44 = cbind(VR4, re = cdata[cdata$date > "2015-01-01", ]$re)

ggplot(VR44, aes(x = date, y = re, color = "red")) + geom_line(size = 0.8) + geom_line(aes(x = date,

y = -VAR, color = "blue")) #VaR应该是损失,把日收益率引入

### 计算每只股票最近3年内跌幅超过VaR预测阈值的次数

VaR_count = (VR44$re < (-VR44$VAR)) %>% sum()

sprintf("收益率超过VaR阈值的次数: %d,", VaR_count)

#> [1] "收益率超过VaR阈值的次数: 9,"sessionInfo()

#> R version 4.0.2 (2020-06-22)

#> Platform: x86_64-apple-darwin17.0 (64-bit)

#> Running under: macOS Mojave 10.14.5

#>

#> Matrix products: default

#> BLAS: /Library/Frameworks/R.framework/Versions/4.0/Resources/lib/libRblas.dylib

#> LAPACK: /Library/Frameworks/R.framework/Versions/4.0/Resources/lib/libRlapack.dylib

#>

#> locale:

#> [1] zh_CN.UTF-8/zh_CN.UTF-8/zh_CN.UTF-8/C/zh_CN.UTF-8/zh_CN.UTF-8

#>

#> attached base packages:

#> [1] stats graphics grDevices utils datasets methods base

#>

#> other attached packages:

#> [1] PerformanceAnalytics_2.0.4 ggfortify_0.4.10

#> [3] RColorBrewer_1.1-2 dygraphs_1.1.1.6

#> [5] lubridate_1.7.9 dplyr_1.0.1

#> [7] stringr_1.4.0 scales_1.1.1

#> [9] ggplot2_3.3.2 quantmod_0.4.17

#> [11] TTR_0.24.2 xts_0.12.1

#> [13] zoo_1.8-8 plyr_1.8.6

#>

#> loaded via a namespace (and not attached):

#> [1] Rcpp_1.0.5 compiler_4.0.2 pillar_1.4.6 formatR_1.7

#> [5] tools_4.0.2 digest_0.6.25 jsonlite_1.7.0 evaluate_0.14

#> [9] lifecycle_0.2.0 tibble_3.0.3 gtable_0.3.0 lattice_0.20-41

#> [13] pkgconfig_2.0.3 rlang_0.4.7 curl_4.3 yaml_2.2.1

#> [17] blogdown_0.20 xfun_0.17 gridExtra_2.3 withr_2.2.0

#> [21] knitr_1.29 htmlwidgets_1.5.1 generics_0.0.2 vctrs_0.3.2

#> [25] tidyselect_1.1.0 grid_4.0.2 glue_1.4.1 R6_2.4.1

#> [29] rmarkdown_2.3 bookdown_0.20 farver_2.0.3 tidyr_1.1.1

#> [33] purrr_0.3.4 magrittr_1.5 htmltools_0.5.0 ellipsis_0.3.1

#> [37] colorspace_1.4-1 quadprog_1.5-8 labeling_0.3 stringi_1.4.6

#> [41] munsell_0.5.0 crayon_1.3.4